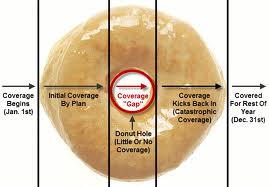

Every big MN insurance company knows that I’m going to get Medicare benefits next year because my mailbox has been full with their enticements for months. I am reading them because I don’t understand the Part D donut hole trap. My DH and I may pick different plans. I’m considering a Medicare Medical Savings Account (Advantage) plans so I can use the account funds for a non-network dentist. However, I’ve discovered that veterans enrolled in VHA cannot join Medicare Medical Savings Account (MSA) plans! No explanation for this rule is offered on the MSA webpage–see “Who Can Join, right menu.” My DH will have VA, original Medicare and maybe a stand-alone dental insurance.

Every big MN insurance company knows that I’m going to get Medicare benefits next year because my mailbox has been full with their enticements for months. I am reading them because I don’t understand the Part D donut hole trap. My DH and I may pick different plans. I’m considering a Medicare Medical Savings Account (Advantage) plans so I can use the account funds for a non-network dentist. However, I’ve discovered that veterans enrolled in VHA cannot join Medicare Medical Savings Account (MSA) plans! No explanation for this rule is offered on the MSA webpage–see “Who Can Join, right menu.” My DH will have VA, original Medicare and maybe a stand-alone dental insurance.

Dental insurance? It costs less to insure our Civic to the max than to buy a premium dental plan with a lousy $1,500 yearly spend limit. Dental insurance is a major rip-off for consumers but we may allow ourselves to be suckered into a basic plan if sanitary skillful local dentists are covered and accepting new patients. That’s a big if.

Dental insurance? It costs less to insure our Civic to the max than to buy a premium dental plan with a lousy $1,500 yearly spend limit. Dental insurance is a major rip-off for consumers but we may allow ourselves to be suckered into a basic plan if sanitary skillful local dentists are covered and accepting new patients. That’s a big if.

(Veterans with dependent kids will be glad to know that when ACA kicks in, thousands of children (until 19) will get pediatric dental benefits through the exchanges. I’ve only checked Vermont’s exchange.)

The Part D Donut hole. I finally found a YouTube video that cleared up my confusion. The presenter, a medigap sales person, explains a smart tip to stay out of the blasted hole for as long as possible. Once you see this video, you’ll see how tricky the no/low deductible and premium carrot plans like Humana’s cheapie Walmart Part D plan, isn’t necessarily a good deal. His basic advice is to buy your $4 generics at Walmart, Target, etc. for cash and only your branded drugs with your part D plan card. All I can say is, watch the video to understand why. Be aware that different plans put the same drugs in different tiers and may have deductibles. By design, the whole thing requires a lot of tedious study. The medical industry is counting on us to give up and go for the easy carrots and cheerful sales messages.

If you receive primary care at the VA, you don’t have to worry about this. Based on your VA priority level, your meds will be cost-free or $9.00 per med. Your VA primary doctor will also accept prescriptions from your non-VA doctor (last paragraph).

For those who might be taking the new pill form of HCV drugs next year, I expect the VA would be the least expensive route because even when one has passed through the donut hole into the covered catastrophic donut cake, you’ll still pay co-pays and/or co-insurance. Over the next few years, the gaps may close and the discount percentages improve, but the drug companies can just raising their prices. The insurance plans will increase their dispensing fees. (I’ll try to find some good plan D calculators links to post later.)

The take-away is to stay away from Medicare’s donut hole if possible and donuts, even chocolate ones, in general. And possibly self-insure and manage your own dental care in a health/medical saving health account plan or private bank account.

I just got a 90 dollar Bill for a 14 day supply of a pain med I am on, the Part D said I have 4500 more to go this year to get it covered, and it starts all over in 2014, Its a screw Job and The VA can not get me in to are local VA, for a least 6 months, see I just moved from CA to WA.So No VA for me even thought I am Service connected. You have to be Really Good at Math and have a ton of Time to understand this Health care, Death Care stuff. The VA lost my Trust years ago, and This NEW Health care Crap seems just as bad. Good Luck to US all WE will need it.

That wait is too long to see a primary and get free meds. Is that for the main VA hospital or a VA rural clinic? Call the Veteran Crisis Line and complain! Maybe you can get on the telehealth program and be seen earlier. A vet commented here on ASKNOD recently that has had a good experience with it for 6 months.

And yes, these plans are a quagmire and it does take time to figure out how to get the most coverage for the least amount of total out-of-pocket expenses.

You have until Dec. 7th to change plans during open enrollment so it might be worth your while to look at all the Medicare options in your zip code.

Mmmmmmmmmm doughnuts! Between the VA and Medicare you can pretty much be covered for most instances and if you reach the magic number you can get in on the dental coverage as well.